An Industrial Re-evolution: From CapEx to OpEx

Lessons from the past tell us that when companies challenge general business assumptions and pre-existing systems, it often leads to big rewards. However, each of the terms used to describe this change: business transformation, challenge the status quo, and paradigm shift have been casually tossed around in conversations with no real definitive explanation.

What paradigm shifts are we seeing? How has the nature of conducting business changed? And what does this mean for businesses going forward?

OpEx: The Industrial Megatrend

In any company’s growth cycle, a time may come when antiquated systems, outdated equipment, and pre-existing methodologies are no longer fit for purpose, and as a result, companies must alter their strategies in order to stay relevant and competitive.

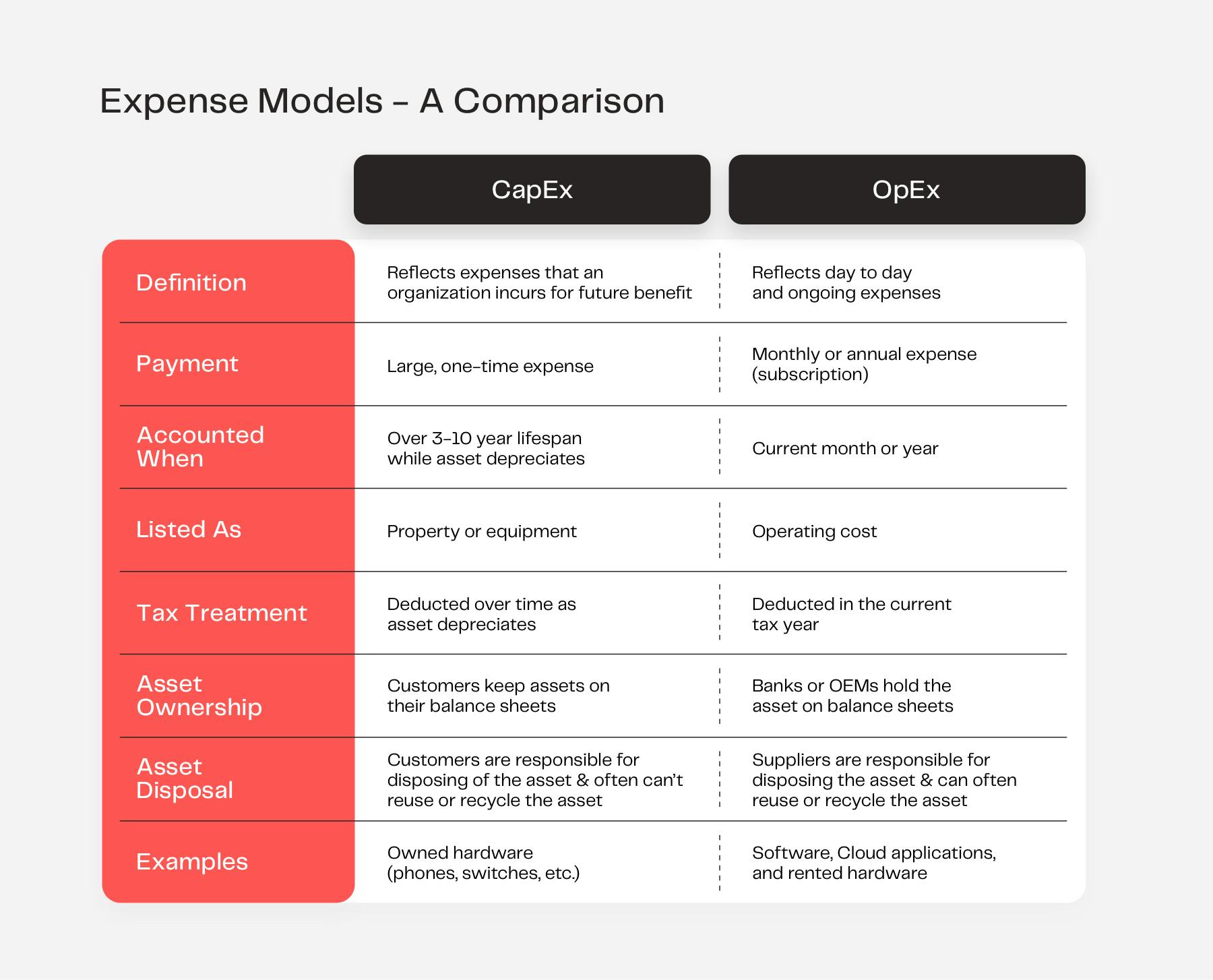

What once began as B2C has now readily moved into B2B. Over the last decade, we have encountered companies switching to conduct business online and see a major shift toward what is now widely known as the “subscription economy”. We’ve seen global manufacturers localize their supply chains, and ‘as a service’ models evolve. However, the biggest change that we’ve experienced is the movement in expenditure models from capital expenditure (CapEx) to operational expenditure (OpEx).

It's worth mentioning that if a company signs a lease contract with a term of more than one year, it will most likely be a lease contract under IFRS 16 and will have to be recognized as an asset and corresponding liability. In this case, the asset will still be on the balance sheet. The accounting treatment of such arrangements must be looked at carefully to arrive at the appropriate accounting treatment.

The industrial industry (manufacturers, production factories, distribution hubs, etc.) is where we are seeing the greatest impact of the OpEx trend.

Why?

Purchasing manufacturing machinery or industrial equipment usually takes a heavy toll on the company's bankroll. When companies purchase expensive equipment, it requires well-forecast budget estimates and long approval processes.

Rapidly advancing product generations and changing consumer demands are making it increasingly difficult for companies to estimate future capacity needs for static equipment and services. With capital expenses, companies strive to maximize ROI e.g. by increasing efficiency, extending lifetime value, and optimizing maintenance costs — all of which are processes that have to be managed.

However, the nature of business is changing. Companies are now strategizing ways to achieve ROI sooner and are moving away from buying machinery outright since its value is no longer tied to ownership. Instead, we are seeing industrial IoT machine subscription models, pay-per-outcome, and real-time leasing become more prevalent. A study by the Business Innovation Observatory of the European Commission illustrates that 70% of machine manufacturers consider services to be a key competitive differentiator. Machine manufacturers who shifted towards service-based business models have seen 5% to 10% annual business growth, with services generating 50% of their revenues.

Service business models are poised for growth because companies want outcomes, not ownership.

OpEx Models: Becoming a Change Agent

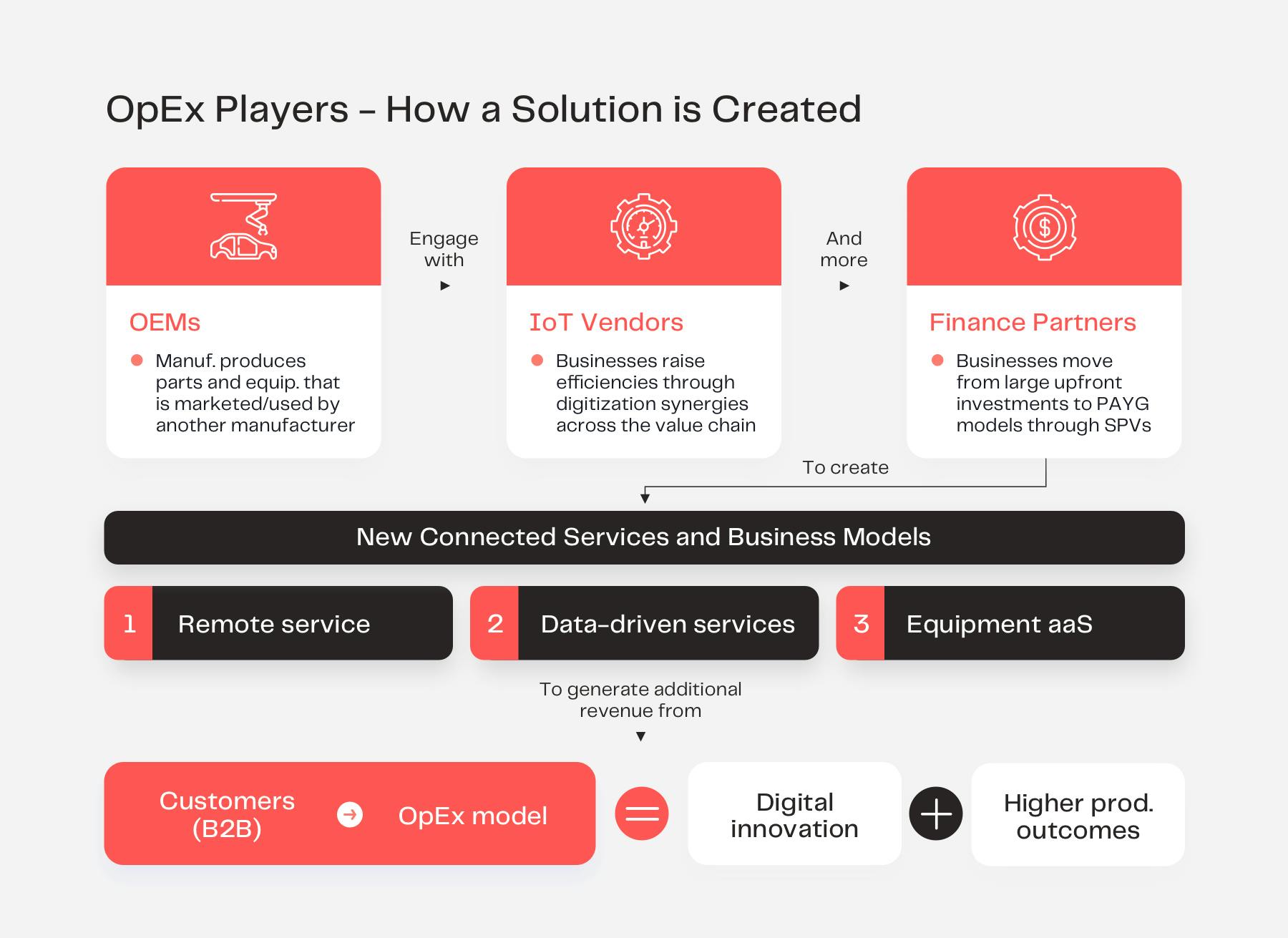

A new order of conducting business – ‘as-a-service’ – is facilitated by OpEx-based models. Especially in today’s era of the Machine Economy, companies offer equipment-as-a-service (EaaS) where they can either hire or lease out equipment based on specific needs and planned production cycles. Smaller organizations are looking for solutions that they can easily scale as their business grows and where IoT adds a new layer of services to static equipment. By saving on the large upfront investment cost associated with purchasing machines, new businesses can participate in the market as a result of reduced barriers to entry. Using an EaaS solution to enable an OpEx-based model allows organizations to unlock money that was formerly frozen in CapEx purchases and direct it toward other business needs.

Today, companies are increasingly treating hardware and technology - more specifically IoT - as an operating expense.

For example, Company 1 — an original equipment manufacturer (OEM) — produces a 3D print machine. Company 2 — an automotive manufacturer — hires out or pays a monthly fee for this 3D print machine to produce samples and tools at a low cost. This pay-per-use model eliminates future losses in production when investing in high-cost tooling. Since Company 1 — the OEM —wants to extend its revenue stream on top of leasing out the 3D printer, the company offers repairs and maintenance services (servitization layers) over the period of the lease agreement. Beyond this, Company 1 also offers a digital IoT platform that can connect to Company 2’s software, computers, or mobile devices, so that Company 1 can measure the performance parameters of the 3D printer.

IoT solutions are fast-tracking the movement from CapEx investments to usage-based OpEx systems. IoT enables an application to be networked with smart sensors embedded in the equipment to deliver real-time, accurate information to indicate performance metrics, equipment condition and gives both companies the data to make better business decisions based on asset utilization. However, it is crucial to consider the total lifecycle cost in the decision-making process.

For OpEx integrators and providers, this expense model ensures a steadier cash flow. For end-users, paying a service fee enables consumers to ‘spend when needed’ and allows for more advanced technologies and equipment to be within reach.

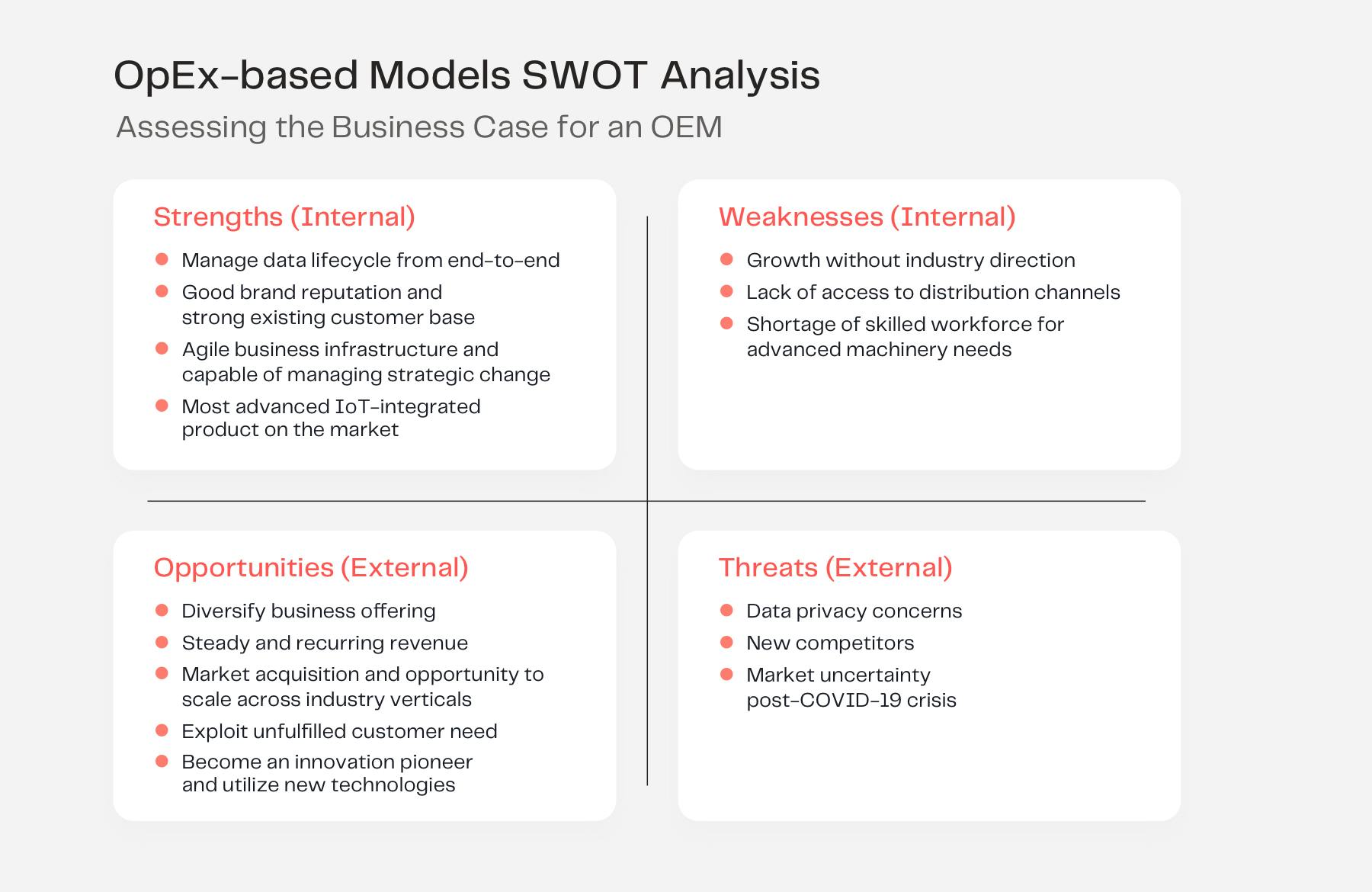

In order to identify the right expenditure model for a business, companies can conduct a simple SWOT analysis to determine whether OpEx should form part of their strategic planning. SWOT is a simple yet powerful tool that helps companies identify their existing resources, capabilities, deficiencies, opportunities and threats prevailing in the market.

Below is an example of a SWOT analysis conducted for an OpEx model to assess its business viability and potential future value generation.

Assessing the Benefits of OpEx-based Business Models

IoT generates and collects valuable data for businesses to more effectively compete, innovate, and scale. With OpEx models, companies can expect:

- Lower Setup Costs

In many areas, there’s no longer a need for large upfront investments in equipment that won’t achieve an ROI for years to come. Beyond this, IoT provides a solution to integrate networked platforms that reduce the cost of measuring equipment performance and usage.

- Mature Financing Tools

For businesses, new financing options become available with the simple management of cash flow. With monthly subscription billing, financial forecasts are stable and predictable which results in better asset management.

- New Accounting Regulations

EaaS models comply with new industry regulations and minimize assets on the balance sheet. Since companies are only paying for the utilization of the industrial asset, the service provider is responsible for the maintenance of the equipment and making sure service level agreements (SLAs) are met.

- Substantial Value Adds

With IoT and other advanced technologies, companies are able to collect and analyze data that will help them to better understand consumer behavior, usage patterns, and production output. With EaaS growth imminent, OpEx-based business models open up collaboration opportunities with strategic industry partners.

- Increased Operational Transparency

OpEx models enable greater visibility and control over resource allocation that gives decision-makers access to information that could impact the success of the business.

- Increased Data Reliability

EaaS enables manufacturers to access production benchmark data to help optimize machine utilization and productivity. The accuracy of the benchmarked data can convince businesses to integrate data-driven strategies that optimize productivity.

- Additional Service Layers

Consumers aren’t responsible for maintaining and repairing the equipment, which means they don’t have to have in-house service technicians or pay for additional service contracts. With OpEx, there is the added benefit of service layers (installation, predictive maintenance, repairs, reporting, etc.) which the equipment provider is responsible for.

- Business Agility

OpEx models give businesses the flexibility to scale the company’s infrastructure and development as needed. OpEx enables improved decision-making, optimized operational output, and better risk mitigation.

- Accelerates Reputation as an Innovation and Technology Pioneer

OpEx allows for capital previously locked up in CapEx expenses to instead be used for innovation and emerging technologies. This coupled with the flexibility of OpEx enables companies to leap ahead and stay relevant in an increasingly competitive landscape.

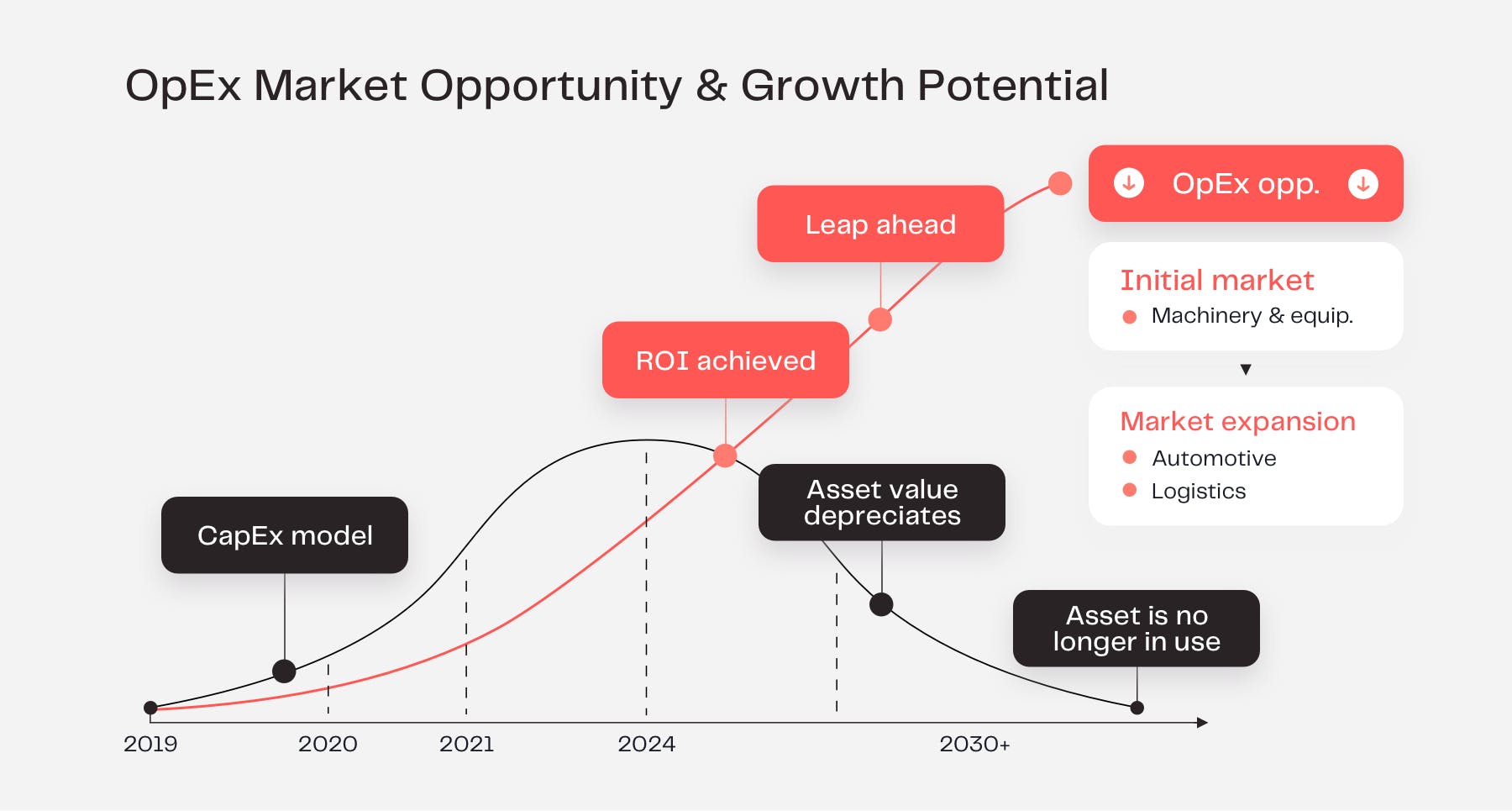

Assessing EaaS Market Potential

According to IoT Analytics, 58% of manufacturers indicate that they would prefer to procure equipment as a service or lease it instead of keeping it on their balance sheet. This is especially true in times of crisis, where this conversion of CapEx to OpEx makes it much easier for companies to scale down costs as demand disappears.

Another major benefit of an OpEx model is that the consumer experiences the advantages of pay-per-use models or consumption-based pricing for manufacturing equipment. As the EaaS market continues to gain traction, more B2B consumers will only pay for the usage of the product and not for the product itself, making the operational cost foreseeable and comparatively lower than purchasing the asset outright.

Outlook for the Next Decade: The Machine Economy

It’s impossible to tell without absolute certainty what the future will look like, but based on current trends we can make calculated predictions on where the market will move next.

In recent years, growing market pressure and its financial effects are trending toward OpEx models with the acquisition of technology ‘as-a-service’. The margins for service sales are around 25%, which is about 2.5 times higher than the margins of new sales in the machine manufacturing sector.

Procuring services on an ongoing basis with monthly subscription payments spreads out costs and adds greater flexibility for companies to scale services as required. OEMs interested in EaaS will have to leverage the cloud and IoT platforms to drive data collection and processing initiatives in order to take full advantage of what OpEx has to offer.

The convergence of hardware and software ties the ongoing use of the product directly to the manufacturer, as consumers become reliant upon the manufacturer for software support and updates. This enables manufacturers to establish a long-term business relationship with customers over the lifecycle of a product, providing extensive support and the option to add more features to existing products.

The industrial sector is on the cusp of new business model innovation that will entirely change equipment ownership. In ten years from now, more businesses - specifically manufacturers - will support this trend to purchase outcomes, not assets. While it’s important to get buy-in from decision-makers to reap the benefits of OpEx, companies must develop a plan of action from the bottom-up with the support of advanced technologies. Industry leaders will find ways to stay close to these developments and make the most of them.