Blockchain Protocols to Consider: A Chain Analysis

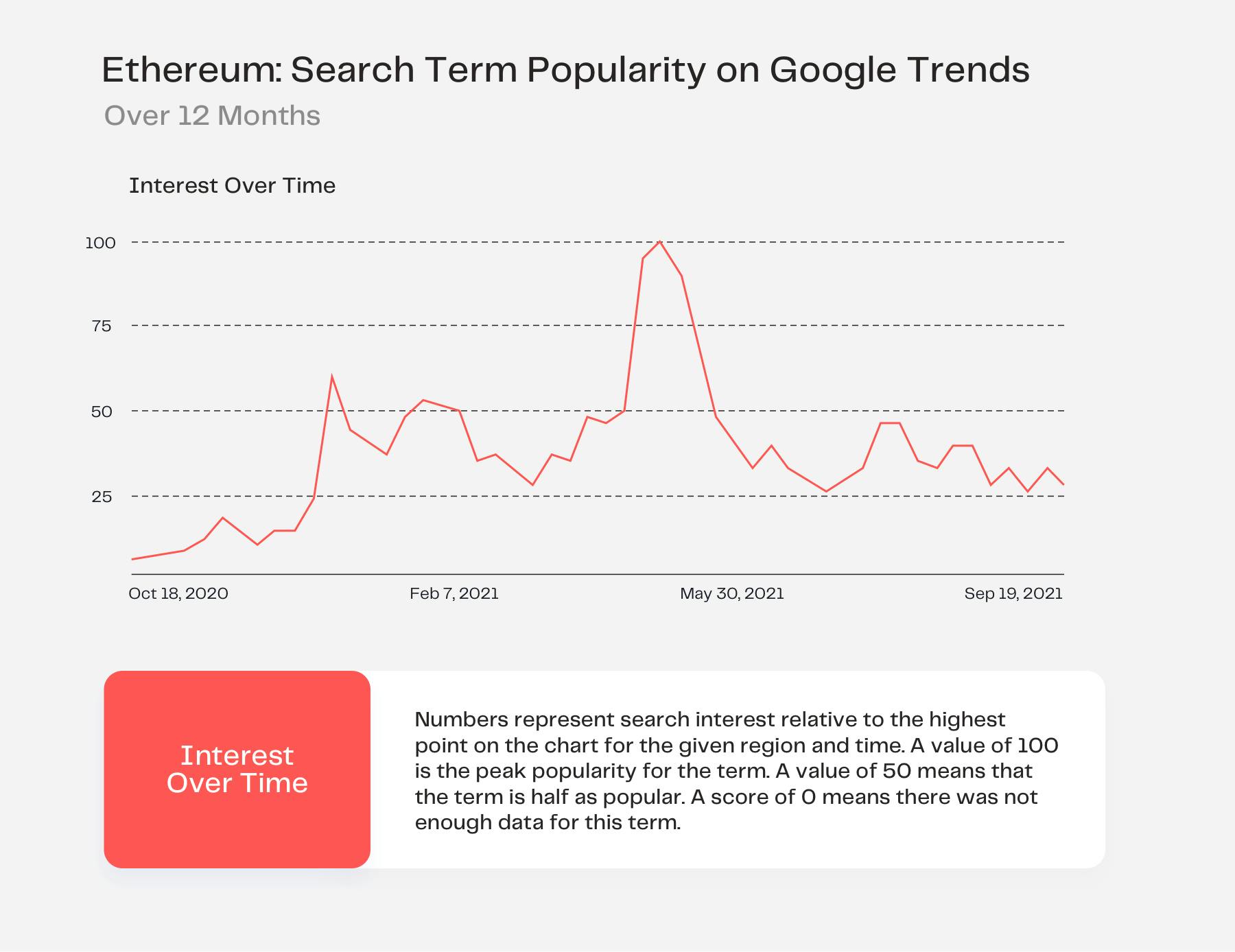

In February 2021, it was reported that more than 100 million people around the world were using cryptocurrencies. The last 12 months have been considered a period of strong user growth which can be largely attributed to the surge in the price of bitcoin (BTC) and other digital tokens.

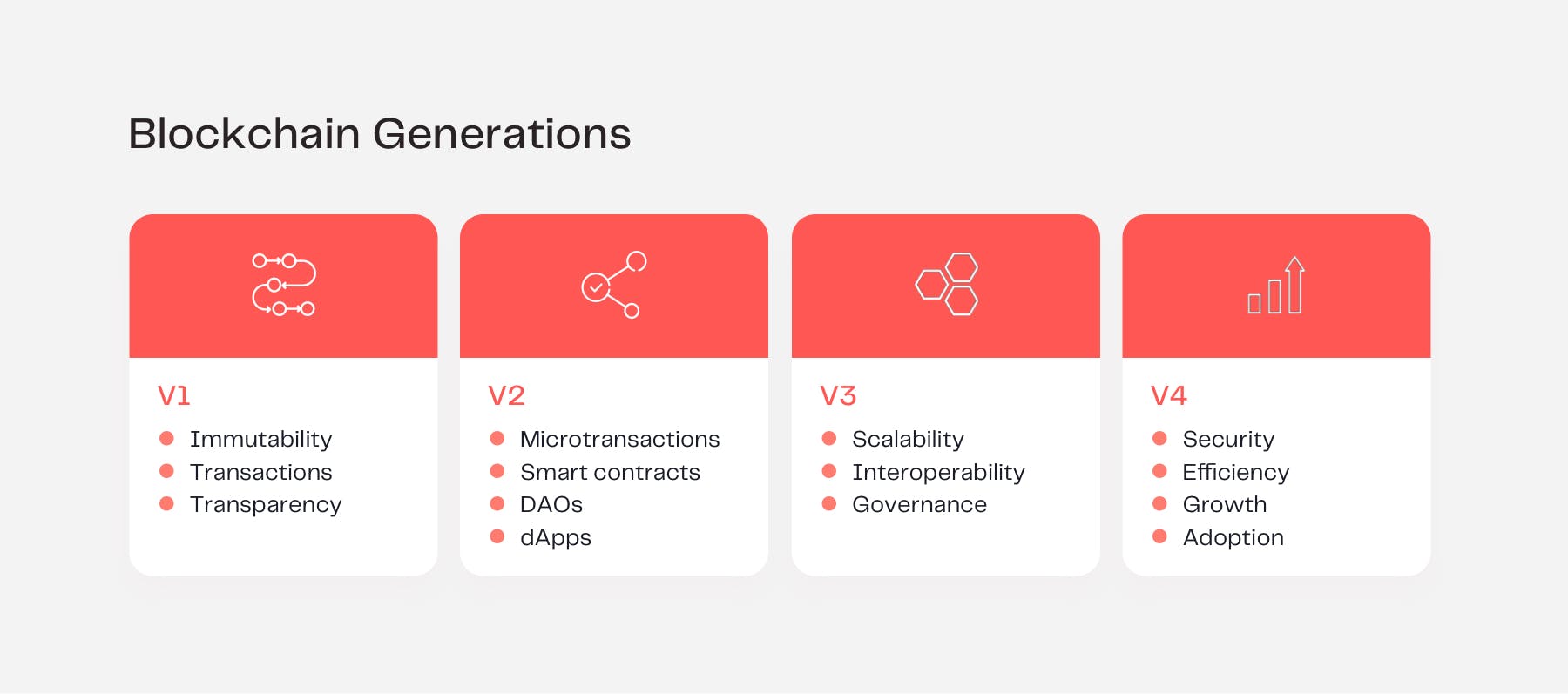

However, blockchain technology extends its value proposition far beyond the digital money market. Since the inception of blockchain in 2008, members of the community have experienced both the highs and lows associated with the uncharted development of such a novel technology. Over the years, the technology has evolved which has spurred the onset of multiple blockchain protocols, each with its own set of design features aimed at solving several of the industry’s biggest challenges, namely high transaction fees, scalability issues, and a lack of interoperability.

While bitcoin may have initially laid the foundation for a new era of peer-to-peer financial services, it was Ethereum (2015 — initial release date), the first smart contract-powered blockchain, that made it possible to execute complex transactions required by modern financial applications. This became known as the decentralized finance (DeFi) market and it reduced many of the accessibility barriers in traditional finance for individuals eager to explore digital financial tools.

DeFi embodies a global ecosystem of open, decentralized, and trustless financial services, giving users greater exposure, control, and visibility over their assets. The idea that anyone, anywhere in the world can have access to a financial system that enables users to transact with one another and select their financial exposure is a truly powerful thing.

The Top Blockchain Protocols

There are hundreds of blockchain protocols in existence and the swift development of the technology means that new protocols are regularly being introduced to the market. These new protocols are often dubbed as the next “Ethereum killer”, aiming to reduce Ethereum’s share in the market and capitalize on improving on one or more of Ethereum's main shortcomings, such as network speed and high gas fees (transaction fees).

Coupled with the explosive growth of DeFi, countless new protocols are continuing to emerge, making the blockchain ecosystem difficult to navigate, especially for entry-level players. DeFi in particular demands more active participation from users, in contrast with the set-and-forget approach many are accustomed to. That is why each individual must conduct thorough research before investing their resources in any particular protocol.

While new market entrants often make it difficult to assess the current legitimacy and future potential of the protocol, it sparks innovation within a growing ecosystem that requires more inclusive access. Most DeFi projects are built on Ethereum, making it the standard for many decentralized applications (dApps). However, scalability has become a well-known issue for the Ethereum community which has resulted in significant challenges for users. As a result, blockchain protocols such as Binance Smart Chain, Polkadot, Solana, Cosmos, Avalanche, and layer 2 solutions like Polygon have emerged to solve some of the challenges experienced by Ethereum users, such as frustratingly high gas fees and network congestion.

For those who are unfamiliar with layer 2, it's a collective term for solutions designed to help scale applications by handling transactions off the Ethereum Mainnet (layer 1).

These blockchain protocols were not developed to “kill Ethereum” as previous reports tend to indicate, but rather to provide a multichain approach to building Web 3.0 which is an idea for a version of the internet that is decentralized and based on peer-to-peer technologies.

Before making any decisions about which platform to use, it’s important to understand the nuances associated with each protocol as outlined below.

Ethereum

Ethereum is a decentralized, open-source blockchain powering the cryptocurrency ether (ETH), and thousands of dApps. When Ethereum first launched, its smart contract functionality and dApps were considered revolutionary technology. This inspired many developers and Web3 enthusiasts to build communities around the protocol, expanding the ecosystem and growing the number of applications that span financial instruments, gaming, art, and more.

Currency

ETH is the native currency of Ethereum. At the time of writing, the ETH price (USD) was valued at $4,595.78. Ethereum experiences high levels of on-chain activity driven largely by usage across decentralized exchanges (DEXs) and a growing interest in non-fungible tokens (NFTs). At a basic level, an NFT is a digital asset that links ownership to unique physical or digital items, such as works of art, music, videos, and more.

Size of the Ecosystem

As a measurement for its worth on the open market, as well as the market's perception of its prospects, the current market capitalization of ETH is valued at over $535 billion.

Consensus Mechanism

In the future, Ethereum will switch from its current proof of work (PoW) consensus mechanism to a proof of stake (PoS) model. This multi-phased upgrade aims to address Ethereum’s scalability and security through several changes to the network’s infrastructure and is a key part of the community's strategy to scale Ethereum via ETH2 upgrades.

Block Time

Block time is a measure of the time it takes to produce a new block, or data file, in a blockchain network. At the time of writing, the Ethereum average block time was recorded as 13.61 seconds.

Transaction Fees

Gas powers the Ethereum network. Gas is the unit that measures the amount of computational effort required to execute specific operations on Ethereum. A gas fee is paid in ETH and is denoted in gwei. Each gwei is equal to 0.000000001 ETH. At the time of writing, the current transaction fee was valued at 108 gwei. There are several tools one can use to determine the gas price required to execute a transaction:

Smart Contract Support

Ethereum pioneered the concept of smart contracts for the blockchain space.

Solana

Solana is an open source project implementing a new, high-performance, permissionless blockchain. Solana has achieved fast transaction speed without implementing layer 2 products such as side chains. Solana describes itself as the fastest blockchain in the world with the fastest-growing ecosystem in crypto, with over 400 projects spanning DeFi, NFTs, Web3, and more. However, more recently Solana featured in the headlines after the blockchain stopped processing transactions back in September 2021. This halt was caused by a denial of service attack on the blockchain as a result of resource exhaustion in the network. Developers have since released an update that showcases how the Solana team will resolve resource exhaustion issues going forward.

Currency

SOL is the native token in Solana's ecosystem. The maximum supply of SOL caps at 489 million SOL. Currently, Solana’s market cap is valued at over $72 billion.

Size of the Ecosystem

Since February 2018, the Solana ecosystem has experienced consistent developer activity, experiencing only two months where there were less than 200 GitHub commits.

Currently, Solana has over $11 billion locked in DeFi and boasts over 1000 active validators. In addition, The Tie recorded that a surge in the price of SOL and continuous ecosystem development sparked a ton of interest on Twitter. In May 2021, it was recorded that there were over 4000 Tweets sent out about Solana daily and the tone of these Tweets was becoming increasingly positive.

Consensus Mechanism

Solana combines PoS with Proof-of-History (PoH), giving it a unique hybrid consensus algorithm. PoH relies on cryptography to create a reliable ordering of transactions to solve the issue of agreement on time, and it allows for almost instant finality of hundreds of thousands of transactions per second.

Block Time

Solana’s current implementation sets block time to 800ms.

Transaction Fees

Transaction fees are set by the network cluster based on recent historical throughput. As of June 2021, Solana fees were $0.00025 per transaction but are expected to fluctuate over time. The fees are set by the competition for block space which increases when the traffic on the blockchain increases.

Smart Contract Support

Solana supports smart contracts built with Rust, C++, and C programming languages. However, it differs in its smart contract model from traditional EVM-based chains. The Ethereum Virtual Machine (EVM) can be thought of as the operating system of Ethereum where complex computations take place. EVM compatibility means that different chains can leverage this operating system as a framework to build dApps and other core infrastructure. With EVM chains the logic and state are combined into a single contract deployed on-chain.

General Benefits

- Low Cost — Solana is designed to keep fees low

- Composable — The platform’s single global state enables composability between projects. Solana does not deal with layer 2 or multiple shard systems.

- Scalable — Solana leverages PoH that allows the network to scale at the rate of Moore’s law.

Binance Smart Chain

Binance Smart Chain (BSC) is a blockchain that runs in parallel to the Binance Chain (BC). BSC is a hard fork of Ethereum, and as such, shares many similarities with the Ethereum chain. While BSC is largely centralized, its design goal aims to leave the high transaction throughput of the Binance Chain intact while introducing smart contracts into its ecosystem. BSC is not a layer 2 or off-chain scalability solution.

Currency

Binance’s native utility token, BNB, is used for paying transaction fees, staking, asset transfers, and running smart contracts on BSC.

Size of the Ecosystem

The BSC ecosystem continues to experience high growth with the number of unique addresses on BSC rising by 10x and the total number of transactions increasing by 15x since the beginning of 2021.

Consensus Mechanism

BSC uses a Proof-of-Staked-Authority (PoSA) consensus algorithm which is a hybrid between PoS and Proof-of-Authority (PoA). The PoSA consensus model supports a shorter block time and offers lower fees.

Block Time

According to Binance, the current block time is around three seconds.

Transaction Fees

At the time of writing, the current BSC average transaction fee is valued at $0.56.

Smart Contract Support

Unlike BC, BSC has smart contract functionality and is compatible with EVM chains.

General Benefits

- Faster adoption rates — Binance already has an existing user base which is why it was able to draw exponentially more users to BSC.

- Low transaction fees — BSC is more cost-effective than Ethereum due to the different consensus mechanisms. In addition, gas prices on BSC are relatively constant.

- High transaction speed —BSC transactions have higher processing speed and shorter confirmation times which is an advantage for attracting developers to build apps on BSC.

Polkadot

Polkadot has a multi-chain architecture that aims to connect different blockchains into a single unified network, enabling them to communicate via its Relay Chain. Blockchains that connect with the Polkadot network are known as “parachains.” Polkadot aims to solve two of the biggest criticisms surrounding current blockchain infrastructure — scalability and governance.

Currency

DOT is the native token of Polkadot. The token plays a key role in maintaining and operating the Polkadot network and allows holders to vote on potential code changes and upgrades.

Size of the Ecosystem

Polkadot’s ecosystem activity continues to increase with the total market value of related projects reaching over $75 billion and there are over 145 development projects based on Substrate, a modular blockchain framework that is the foundation of the Polkadot ecosystem.

Consensus Mechanism

Polkadot uses a variant of the PoS consensus algorithm called Nominated Proof-of-Stake (NPoS) which is more efficient than PoW and faster than standard PoS.

Block Time

Polkadot networks are currently operating at a rate of one block every six seconds.

Transaction Fees

Polkadot uses a weight-based fee model as opposed to a gas-metering model like Ethereum. As a result, fees are charged before the transaction, and only once the fee is paid will the transaction be executed. Fees on the Polkadot Relay Chain are calculated based on three parameters: 1) A per-byte fee (also known as the "length fee"); 2) A weight fee, and; 3) A tip (optional).

Smart Contract Support

Polkadot’s Relay Chain doesn’t natively support smart contracts, however, parachains on Polkadot — chains that run parallel to the Relay Chain — will support smart contracts. Moonbeam is one example of a parachain that is a smart contract platform on Polkadot, making it easy to build natively interoperable blockchain applications.

General Benefits

- Unique security model — Polkadot enables independent blockchains with differing degrees of security finalities to strengthen their weak points by pooling their security resources and delegating them to the Polkadot Relay Chain.

- Scalability — Polkadot is designed to allow several parachains to run simultaneously through one Relay Chain with each parachain processing multiple transactions in parallel.

- Customization — With Substrate’s flexible and adaptive architecture, Polkadot enables every individual chain to have its design optimized for specific functionality.

Avalanche

Built by Ava Labs, Avalanche is an open-source platform for launching DeFi applications and enterprise blockchain deployments in one interoperable, highly scalable ecosystem. Avalanche can be described as a "platform of platforms", consisting of thousands of subnets to form a single interoperable network. Avalanche is a high-performance, customizable, secure, and scalable blockchain platform that is focused on improving transaction speed and lowering costs. Avalanche aims to deliver a highly scalable blockchain that doesn’t sacrifice decentralization or security.

Currency

All fees on Avalanche are paid in the native token, AVAX.

Size of the Ecosystem

The TVL in Avalanche is skyrocketing and is now worth over $13 billion across Avalanche dApps. In addition, as part of an ecosystem growth initiative, Avalanche recently launched a $180 million liquidity mining incentives program to strengthen the development of DeFi applications on its network.

Consensus Mechanism

Avalanche comprises three chains: the X-Chain, C-Chain, and P-Chain. The X-Chain is used for managing assets and uses the Avalanche consensus protocol. The C-Chain is for the creation of smart contracts and the P-Chain for coordinating validators. These two blockchains use the Snowman consensus protocol.

Block Time

At the time of writing, the average block time is around 2 seconds.

Transaction Fees

Transaction fees are paid in AVAX which is burned (destroyed forever). Transaction fees on Avalanche are rarely more than a few cents but could reach the single-digit dollar range depending on the complexity and size of the transaction.

Smart Contract Support

Avalanche claims to be "the fastest smart contract platform in the blockchain industry, as measured by time-to-finality". As previously mentioned, Avalanche comprises three chains and developers can create smart contracts on the C-Chain which is EVM compatible.

General Benefits

- Interoperability — While Polkadot has limited space auctioned off in its parachain slot auctions, Avalanche boasts an unlimited number of interoperable blockchains with a simple subscription fee.

- Accessibility — The low cost of transactions on Avalanche opens up the DeFi ecosystem to players who want to make smaller trades.

- Commitment to decentralization — Compared to its size and age, Avalanche has a large number of validators. However, as the price of AVAX rises, it's becoming more expensive to become a validator.

Cosmos

Described as the “Internet of blockchains”, Cosmos is an ecosystem of blockchains that can scale and interoperate. Cosmos simplifies the experience for developers to build blockchains and allows chains to communicate and transact with each other in a decentralized way. With Cosmos, blockchains can maintain sovereignty, process transactions quickly, and communicate with other blockchains in the ecosystem.

Currency

ATOM is the native currency that powers the Cosmos Hub.

Size of the Ecosystem

Currently, the Cosmos Hub has more than $140 billion of digital assets under management. The size of the ecosystem is making great strides with over 250 dApps and is continuing to add more layers to its robust DeFi infrastructure. DeFi projects such as the Gravity DEX, and the automated market maker (AMM), Osmosis, are two use cases attracting significant liquidity to the ecosystem.

Consensus Mechanism

Cosmos is a decentralized network of independent parallel blockchains, each powered by Byzantine Fault Tolerant (BFT) consensus like Tendermint. Cosmos leverages PoS consensus mechanism that achieves high performance with low energy consumption.

Block Time

Transactions are confirmed within 7 seconds.

Transaction Fees

Transaction fees are almost zero at around $0.01.

Smart Contract Support

Cosmos supports smart contract functionality through three core offerings: Agoric Swingset, CosmWasm, and Ethermint. Agoric's Cosmic SwingSet enables developers to test smart contracts build with ERTP in various blockchain setup environments. CosmWasm is a WASM-based smart contract module for the Cosmos SDK. The EVM was implemented as a Cosmos SDK module, making it possible to deploy PoS blockchains that support Ethereum smart contracts.

General Benefits

- Scalability — The Tendermint BFT powers the Cosmos PoS consensus mechanism that enables chains to run in parallel.

- Interoperability — Cosmos removes barriers between blockchains via the IBC protocol, a messaging protocol for blockchains.

- Usability — The Cosmos SDK is a modular framework that makes it easy for developers to build interoperable, application-specific blockchains.

Polygon

Polygon is a protocol and a framework for building and connecting Ethereum-compatible blockchain networks. Polygon is a scaling solution for Ethereum that provides faster and cheaper transactions on Ethereum using layer 2 sidechains which are blockchains that run alongside the Ethereum main chain. Polygon aims to solve some of the core pain points associated with blockchains like high gas fees and slow speeds without sacrificing security.

Currency

MATIC is the native token that powers the Polygon network. Tokens are used for payment services on Polygon and as a settlement currency between users who operate within the Polygon ecosystem. The transaction fees on Polygon sidechains are also paid in MATIC tokens.

Size of the Ecosystem

Currently, Polygon has over $4 billion locked in DeFi. While many of the top projects on Ethereum like Sushiswap, Curve, 1inch, and Balancer have been ported over to Polygon, there are also Polygon-native projects that are gaining popularity and are bringing people to the Polygon ecosystem. There are already more than 1200 dApps live on Polygon and the ecosystem is already experiencing over 7 million transactions per day. There are over 660,000 active wallet addresses.

Consensus Mechanism

Polygon is a layer 2 solution that uses a PoS system of validators for asset security where staking is an integral part of the ecosystem. Transaction data from Polygon is also regularly published to the Ethereum main chain to guarantee blockchain integrity — ensuring the information contained in transactions can be verified as true.

Block Time

Block time currently sits at around two seconds.

Transaction Fees

Recently, Polygon decided to hike its minimum gas fee by 30X as a way to avoid spam attacks on the network. However, the community has had a lukewarm response to the update which became evident with a 50% decline in network activity from October 3rd to October 11th. The considerable decline in network activity appears to be correlated to the recent spike in gas prices. Even with higher transaction fees, when it comes to gas fees Polygon remains a more viable option than Ethereum for smaller trades. The Polygon PoS chain average gas price chart shows the daily average gas price used in the network.

Smart Contract Support

Polygon is EVM compatible which means users can deploy any Ethereum smart contract to the Polygon Network.

While DeFi has become known as the most promising and lucrative opportunity in the cryptoverse, much like its underpinning technology, it’s still in its infancy. Before users decide to explore any one protocol, many different factors need to be taken into account (e.g. size of the community, programming language, transaction speed, security, etc.). What may be true on one chain is not necessarily true for another so it’s worth assessing whether the value proposition(s) of the protocol in question aligns with your needs. It’s always important to research before exploring the space.

Accelerating a Multi-Chain Future

With so many new protocols on the horizon, it’s paramount for the success of the blockchain space to collaborate on infrastructural pieces that move from their current state — chains in isolation — to a connected ecosystem.

While many users remain loyal to one or two chosen protocols, new opportunities are beginning to emerge to interconnect new chains to tackle issues of scalability and interoperability.

Leveraging blockchain’s rich tapestry of various protocols to facilitate cross-chain functionality will advance user experience to be more seamless and efficient — which is just a glimpse of what users stand to gain in a truly multichain world.

-------

Disclaimer: This article does not provide any investment advice. All data is provided for information purposes only and you are solely responsible for your own investment decisions.